- October 2, 2024

- No Comment

- 62

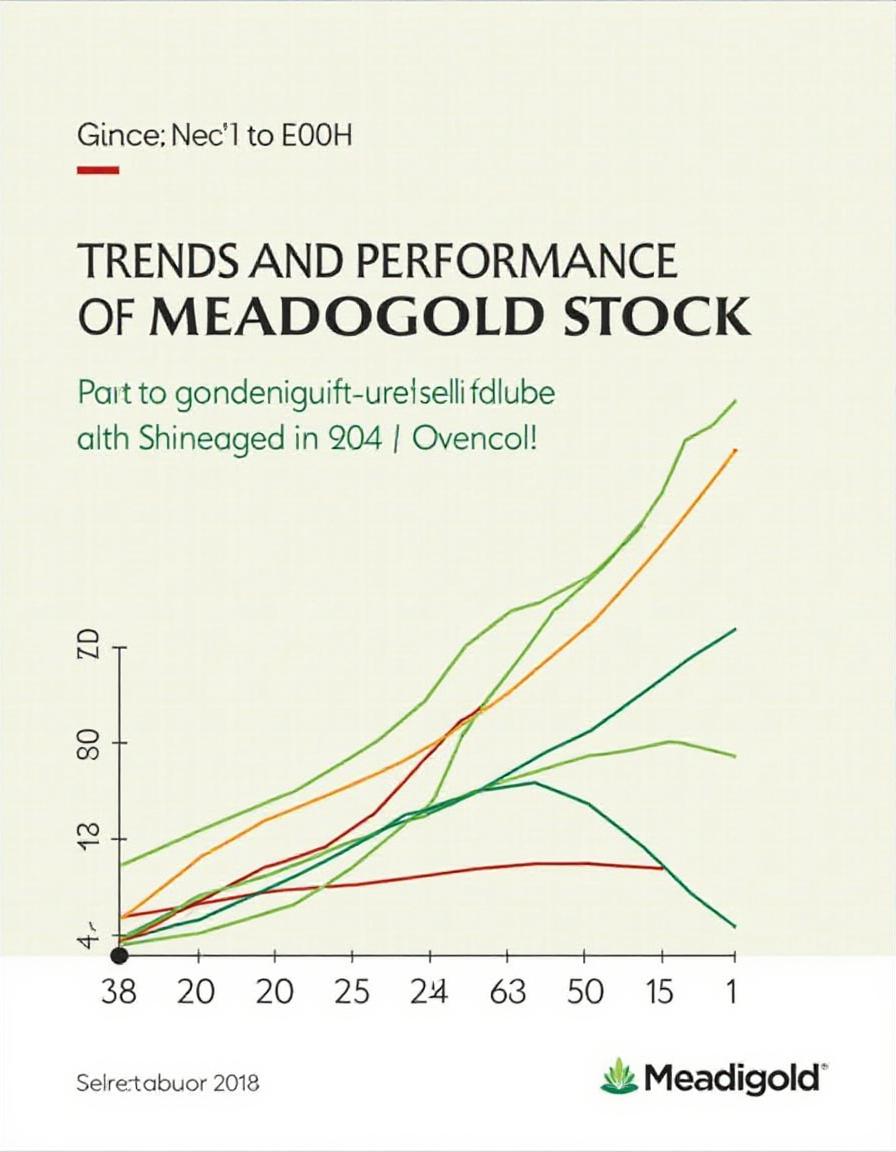

Trends and Performance of Meadogold Stock

Trends and Performance of Meadogold Stock Meadogold, a player in the gold mining sector, is influenced significantly by the broader…

Trends and Performance of Meadogold Stock

Meadogold, a player in the gold mining sector, is influenced significantly by the broader trends in gold prices. In 2024, gold prices have surged, reaching record levels above $2,500 per ounce, primarily due to a weaker U.S. dollar and expectations of interest rate cuts by the Federal Reserve. As of late September 2024, gold is trading around $2,570 per ounce, reflecting a year-to-date increase of approximately 24.67%.

Key Drivers of Gold Price Performance

1. Interest Rate Outlook : The Federal Reserve’s anticipated rate cuts are a major factor driving gold prices higher. Market expectations suggest a strong likelihood of a 50-basis-point cut in the near future, which typically increases gold’s attractiveness as a non-yielding asset.

2. Geopolitical Uncertainty: Ongoing geopolitical tensions, including conflicts in Ukraine and the Middle East, have bolstered demand for gold as a safe-haven asset. This demand is expected to persist as uncertainties surrounding global monetary policy continue.

3. Central Bank Purchases: Increased buying by central banks, particularly from countries like China, has shifted the supply-demand balance favorably for gold prices. This trend is likely to support continued price increases in the medium term.

Performance Metrics

Year-to-Date Increase: Gold prices have risen about 24.67% since the beginning of 2024.

Price Forecasts: Analysts project that gold could average around $2,500 per ounce by the end of 2024 and potentially reach $2,600 in 2025 as economic conditions evolve.

Future Outlook for Meadogold Stock

The outlook for Meadogold stock appears positive given the bullish sentiment surrounding gold prices. Analysts predict that if gold continues to rise due to sustained demand and favorable economic conditions, Meadogold could benefit from increased revenues and profitability.

Investment Strategy: Investors may consider positioning themselves in Meadogold as part of a broader strategy to capitalize on the expected rise in gold prices. The anticipated Fed rate cuts could further enhance this position by making gold more attractive compared to yield-bearing assets.

Market Sentiment: The sentiment among investors remains bullish for both gold and related mining stocks like Meadogold, driven by technical analysis indicating potential upward trends in price movements.

In summary, Meadogold’s stock performance is closely tied to the dynamics of the gold market, which is currently experiencing significant upward momentum due to various economic and geopolitical factors.

Citations:

[1] capex

[2]tradingeconomics

[3] jpmorgan

[4] goldpriceforecast

[5] goldpriceforecast

[6] gold

[7] sunshineprofits

[8] goldenmeadow

FAQs:

What is driving gold prices in 2024?

Gold prices have surged in 2024 due to a weaker U.S. dollar, expectations of Federal Reserve interest rate cuts, and geopolitical tensions.

How much has gold increased in 2024?

Gold prices have risen about 24.67% year-to-date, trading around $2,570 per ounce in late September 2024.

What factors are influencing the rise in gold prices?

Key factors include the anticipated interest rate cuts by the Federal Reserve, geopolitical uncertainty, and increased central bank purchases, particularly by countries like China.

How does this impact Meadogold stock?

Meadogold stock is positively impacted by rising gold prices. Higher gold demand and favorable market conditions could boost its revenues and profitability.

What is the future outlook for Meadogold?

Analysts predict that if gold continues to rise, Meadogold could benefit significantly. There is also a bullish market sentiment for gold and related mining stocks like Meadogold.

Should investors consider Meadogold?

Investors may want to consider Meadogold as part of a strategy to capitalize on rising gold prices, especially with expected Fed rate cuts making gold more attractive.